Affordability Matters: Insight from Water Matters 2025

Water Matters report – what are the findings telling us?

It has been a few months since CCW published our latest Water Matters tracking survey, back in May. As the longest-running in-depth survey of water customers, this research gathers a lot of detail, which is why we are once more following up with a series of shorter ‘mini reports’. These will each look in greater depth at specific themes from the latest Water Matters data.

This summary looks at affordability, value for money and fairness of bills. These are key issues, especially as water bills – and the cost of living more generally – continue to rise, and last year’s survey saw significant falls in satisfaction around value for money.

Headline findings

- This year’s survey has shown a further fall in scores for satisfaction with value for money for both water and sewerage services – these are new record lows

- Customers in England are less likely than ever to consider their water bills as fair – despite the fact that customers are slightly more likely than last year to agree that their bill is affordable

- The picture is slightly more positive in Wales

- More positively, customer awareness of the financial support offered by water companies has increased to almost 50% for the first time – although this is still below the target set in our Forward Work Programme (pdf) of achieving 53% across all companies by summer 2026.

Satisfaction with value for money has reached a record low

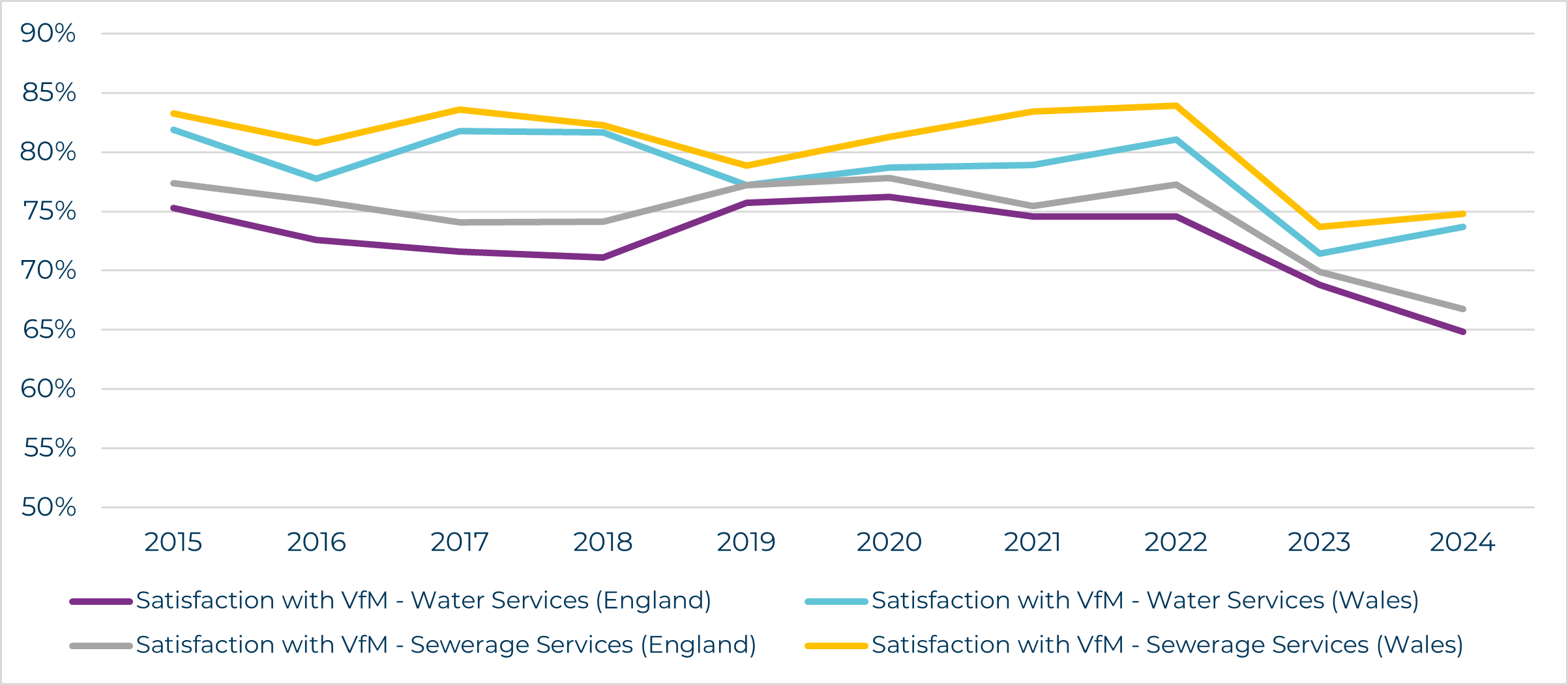

One of the most striking features of last year’s Water Matters was the significant fall in satisfaction when it came to customer satisfaction with value for money, both for water services (which saw a 6% fall) and sewerage services (which saw an 8% fall)

From last year’s record low, we saw further significant falls in satisfaction with value for money: for water services this is now 65%, down from 69% last year, and for sewerage services, 67%, down from 70%. As figure 1 (below) shows, while last year saw falling scores in both England and Wales, this year we have seen more of a divergence between the nations, with a small but significant rise in satisfaction among Welsh customers.

However, this year’s improvements in Wales are not enough to offset the fact that the 10-year trend for satisfaction with value for money in Wales is now negative for the first time. As in England, scores for the last two years have been below the long-term average, reinforcing how far there is to go to correct these more negative trends.

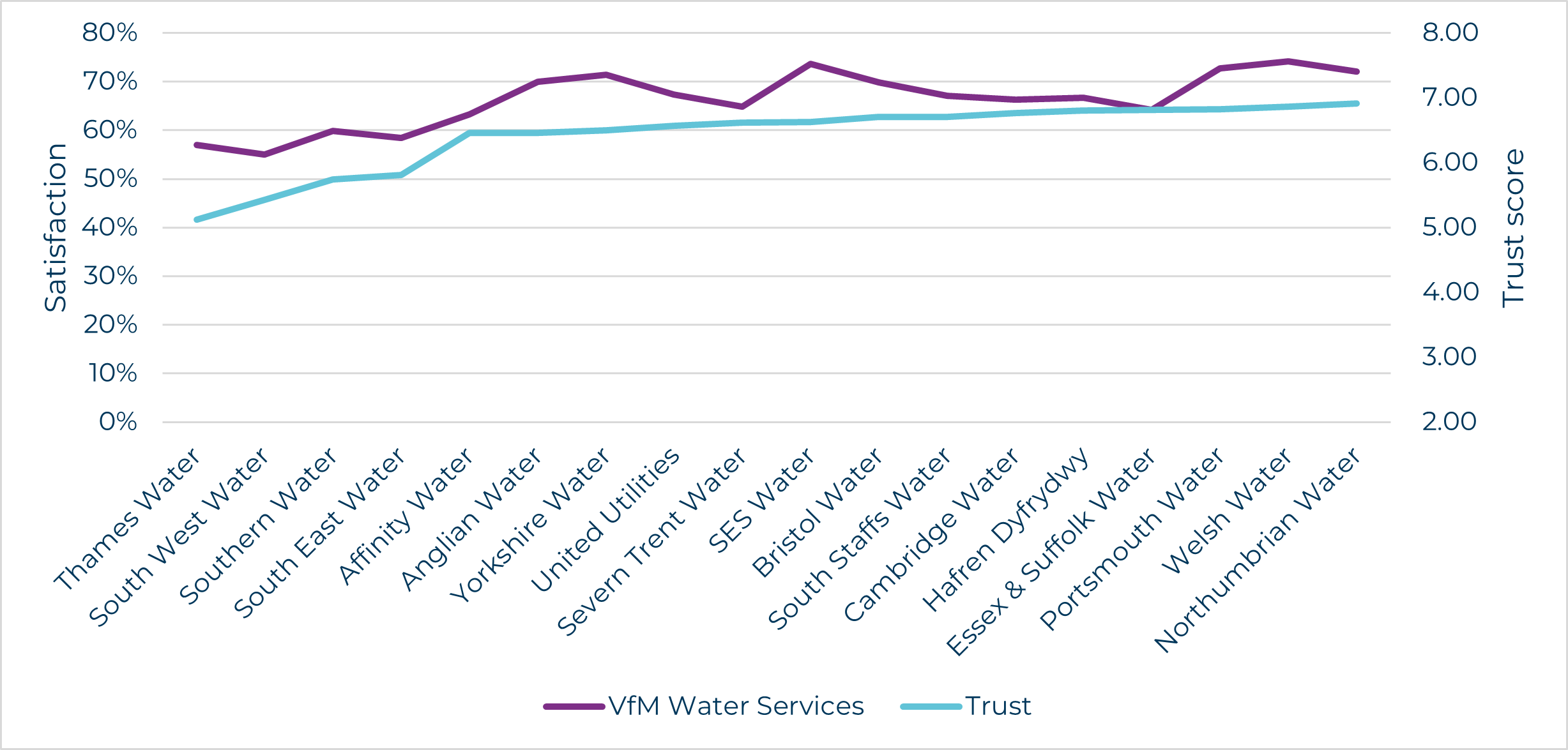

Falling satisfaction with value for money is a concerning development, as it also impinges heavily upon falling trust levels – the most significant story of recent Water Matters surveys. As Figure 2 (below) shows, companies’ varying trust scores broadly mirror satisfaction with value for money of water services. Until customers have greater understanding of, and confidence in, how their water bills are being spent by companies, we will not start to see the long-awaited recovery in trust scores. This is something we will explore further in our next ‘mini matters’ report on environmental performance, as this is the other key component when it comes to falling trust levels.

The gap between affordability and fairness of bills is at its widest level yet

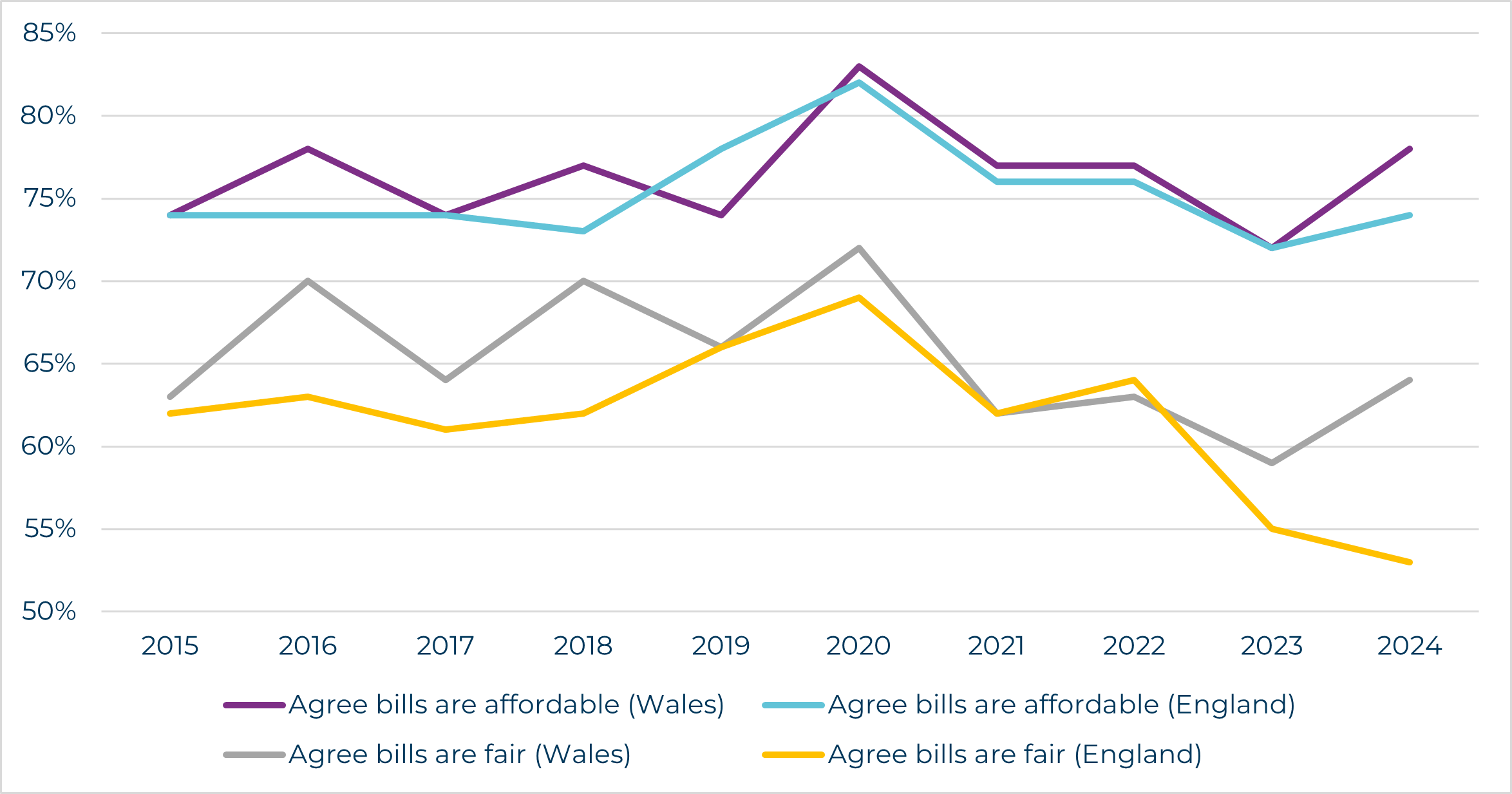

Last year’s Water Matters drew attention to the falling number of customers who agreed that their water bill was affordable – down to a record low of 72%. Although we saw a slight increase this year, up to 74% across England, and 78% in Wales, it should be remembered that fieldwork took place prior to the announcement of substantial rises in water bills.

Of even more interest was that, after last year’s significant drop in customers agreeing that their bill was fair – down from 64% to 55% – the score this year was even lower, just 53%.

In every year of Water Matters results, people have been more likely to think their water bill is affordable than it is fair, with the difference between the overall averages between companies ranging from 8% and 17%. This year, however, the gap has reached its widest ever level of 21%. One possible explanation for this drop in agreement around fairness of bills is that the reduction in trust, which we have been seeing over the past year, has filtered into a stronger feeling around the fairness (or unfairness) of bills. Certainly customers of the companies with low trust scores, such as Southern Water, Thames Water and South West Water, were also among the least likely to agree their charges were fair.

When it comes to feelings around fairness and affordability of bills, we have seen significant divergence between England and Wales this year. While there were significant falls across both metrics in England, the proportion of Welsh customers agreeing that their bills were fair rose this year, from 59% to 64%, and for affordability, the score rose from 72% to 78%.

More positively, awareness of financial support has increased everywhere

One of the more positive trends of recent Water Matters surveys has been the increase in customer awareness around the various support measures that exist for financially vulnerable customers. Our main measurement for this metric is the survey question, ‘Are you aware that your water company offers reduced bills to some households who, due to their financial circumstances, would sometimes struggle to pay their bills?’

Additionally, this year we also saw our highest-ever scores when it came to awareness of water companies’ Priority Services1 (up to 55%, from 50% last year), as well as of WaterSure tariffs2 (up to 19%, from 17% last year).

These are positive long-term trends, although they are indicative of the fact that rising bills are now more at the front of customers’ minds, as our recent Water Worries research showed. It is encouraging that customers are being more proactive when it comes to dealing with these financial pressures. Furthermore, our vulnerable customers data recorded a rise of almost a quarter of a million social tariff customers in England and Wales between Q1 and Q3 of 2024-25 – the largest ever rise in a single year.

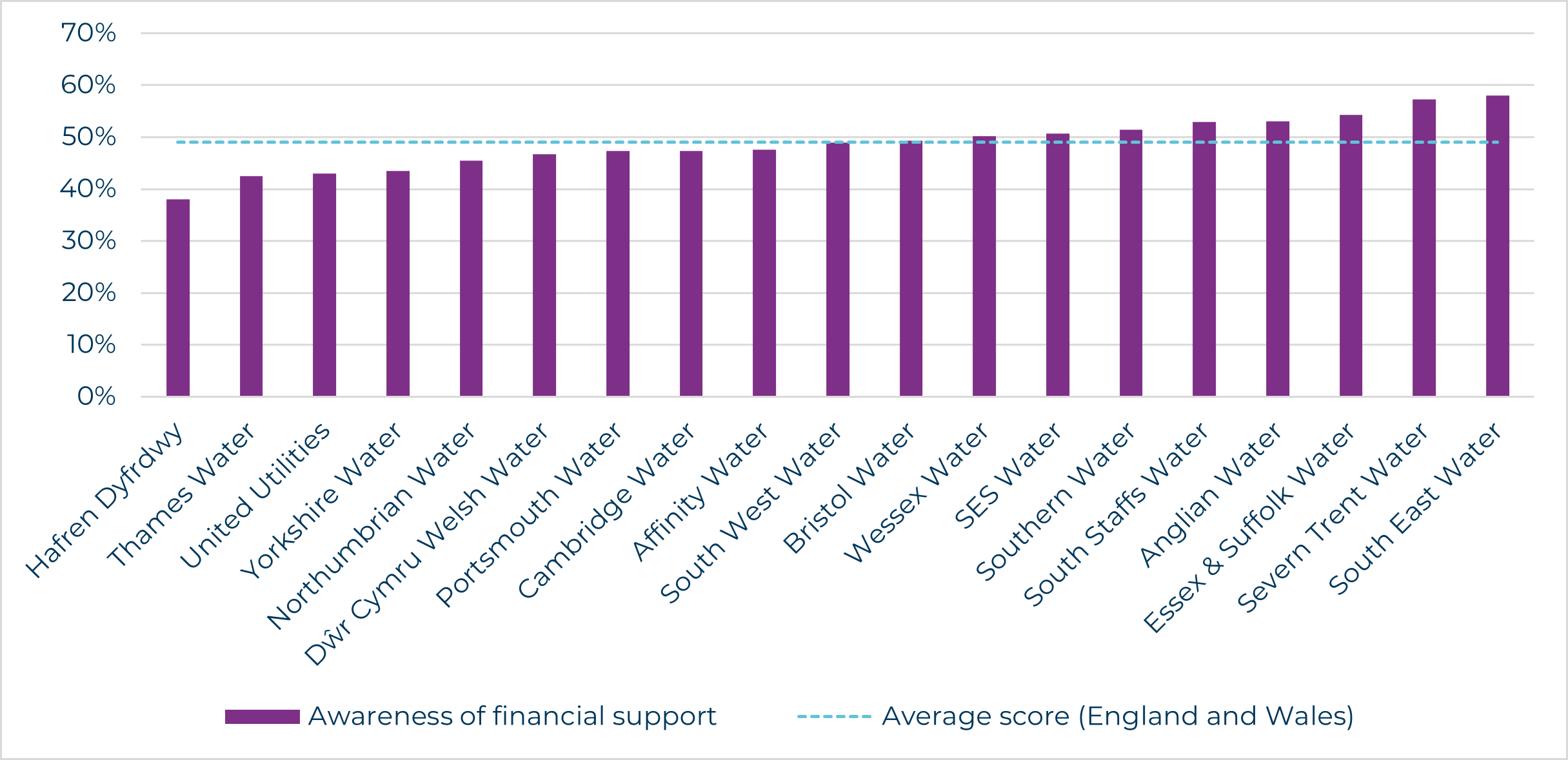

However, as figure 4 shows, we are seeing an increasingly varied picture across different companies. Last year, there was a gap of 13% between the companies with the lowest and highest awareness levels, whereas this year the gap has widened to 20%, from Hafren Dyfrdwy on 38% (slightly lower than last year’s score), all the way up to South East Water on 58%. With such a mixed picture, there is clearly scope for learning between companies, to try and share best practice when it comes to keeping customers informed about available support.

Conclusion

Affordability is a more pressing issue than ever with water customers. As we saw in our most recent ‘mini matters’ report on customer contact, billing enquiries make up a larger proportion (33%) than ever of contact with companies, and our recent Household Complaints report also showed that affordability concerns are rising sharply, up 110% based on the complaints CCW handles.

Complaints made to CCW about the scale of the bill increases rose even more sharply, up 138% on the previous year. More must be done by water companies to help people feel they receive value for money from the service they pay for, and to explain what, why and where their money is being spent.

Similarly, while there has been some progress in improving customer awareness of financial support, this still varies significantly by company, with many still some distance from the long-term target we have set in our Forward Work Programme of all companies reaching at least 53% by summer 2026 (to be measured in Water Matters 2027).

Although satisfaction with affordability of bills has risen slightly in England – and more significantly in Wales – the next round of Water Matters will reveal the full impact of recent bill rises, which took place after the fieldwork for the latest survey. But even if bills are more affordable, the fact that customers are less likely than ever to think their water/sewerage bills are fair is a significant cause for concern. As long as this issue of perceived unfairness continues , companies will find it much harder to revive trust to previous levels.

Our recent research into customer priorities found that people want to see clearer, more transparent messaging from their company on financial decisions and how they affect infrastructure improvements and affordability, in order to understand better how their money is being spent. More than ever, this is an area for companies to focus on when it comes to addressing the issue of ‘fairness’ of bills – and, by extension, starting to rebuild customer trust.

1 Priority services for water customers are designed to provide extra support for those who may need it due to age, ill health or disability, e.g. providing bills and other literature in accessible formats.

2 The WaterSure tariff is designed to assist households that may use more water due to a large family or medical conditions by capping their water bills.