Water Matters 2025

Household customers’ views of their water and sewerage services

Our annual Water Matters survey tracks the views of household customers on the services they receive from water companies in England and Wales.

Foreword

We have been running our Water Matters tracking survey for fourteen years, and it continues to give us invaluable insights into household customers’ views and preferences on water companies’ services across England and Wales. This makes it one of the most comprehensive records of customer views and preferences across any utility.

Until recent years, the trends in people’s views had remained static. While there were annual changes, there was no significant impact on long-term trends. Last year, there was a considerable downward shift across most areas of customer views. All companies had their lowest ever score for customer trust, and there were continued concerns about the cost of living as well as sustained public exposure and scrutiny of water companies’ performance, especially in relation to the environment.

Water Matters 2025 shows some green shoots of recovery from the record low scores of last year. However, there are still significant gaps from previous highest scores. Because of this, along with the declining performance in recent years, we are now seeing more long- term downward trends. We have also seen a slight overall decrease in trust scores in the last year. It is important to acknowledge that the majority of individual company scores have improved this year, and companies are making progress to earn back trust. However, the decrease for a small number of companies has meant the overall score is lower.

Notably, this year’s survey has shown a further fall in scores for satisfaction with value for money and a decline in customers feeling that their water charges are fair. Fieldwork was carried out between 8 July and 15 December 2024, prior to the announcement in January 2025 that water bills were to increase by a record amount from April 2025.

This year has also seen a significant increase in customers contacting their water company – the highest score recorded in Water Matters history. However, the satisfaction with contact has shown no improvement from last year’s record low score.

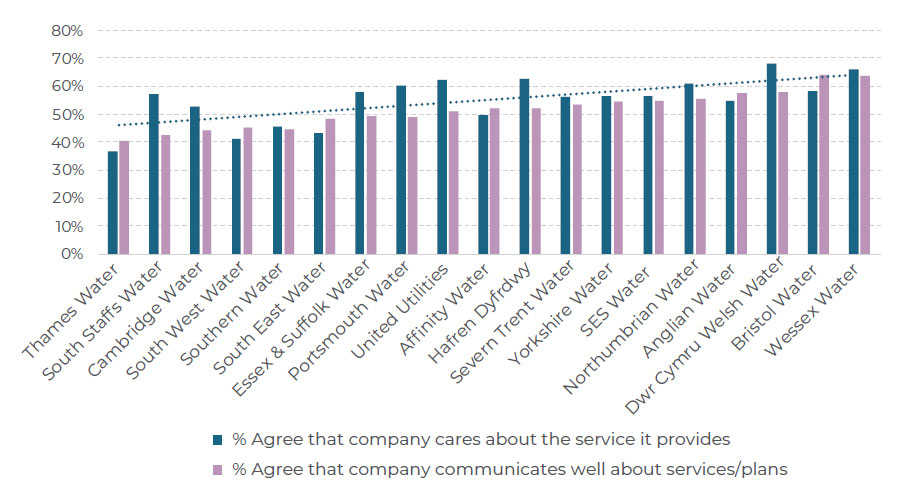

Good quality communication is more important than ever given the spotlight on the water industry around environmental issues, bill rises and some high-profile water quality incidents. Encouragingly, there has been an improvement in customers feeling that companies communicate well about their services and plans. However, it is concerning that 81% of people who didn’t feel this was done well mentioned a lack of regular communication. Our previous insights show that transparency is important to people and can help to rebuild trust.

Customers’ awareness of financial support available has increased by 4% to 49% – almost at the 50% target set by CCW in our 2024-25 Forward Work Programme to be reached in Water Matters 2026. With bills seeing a record rise this year, it is essential that water companies are prioritising raising awareness and increasing the number of customers receiving support through social tariffs.

Although this year we haven’t seen the level of decline we saw in 2024, there are still concerns with the levels of trust and satisfaction. It is clear that there has not been a significant widespread recovery. However, we expect that shifting customer perceptions will take time. Despite the work water companies have already done, there is still a lot more to do for customers to feel an improvement in the quality of their water services and begin reversing these negative long-term trends.

Hannah Bradley, Head of Evidence and Insights

Key numbers for England and Wales

- 6.28 out of 10 – average trust score. This showed a further drop from last year.

- 53% – agree that their company cares about the service it provides, up 3%

- 65% – satisfaction with value for money of water services, down 4%

- 67% – satisfaction with value for money of sewerage services, down 3%

- 27% – contacted their company in the past twelve months, up 2% to highest ever level

- 51% – thought their company communicated well about services/plans, up 4%

- 35% – satisfaction with what their company does to protect the environment, up 2%

- 90% – overall satisfaction with water supply, up 1%

- 64% – overall satisfaction with sewerage services, down 1%

Three key learnings from Water Matters 2025

When considering the results from this research, there are three standout key learnings:

- Last year’s record low-level scores were not a one-off.

- In particular, rising bills are front of customers’ mind.

- Water customers are more likely than ever to contact their water companies.

Together these tell the story of the latest results: a more mixed picture compared to last year’s dramatic falls in score across the survey, with some moderate improvements but further dissatisfaction elsewhere. Overall, most satisfaction metrics are still well below where they were a few years ago.

CCW will publish a small number of additional insight summaries based on the Water Matters data, focusing on wider areas that are not covered in this Highlights Report, during the year. The full results are set out in our data report (pdf).

In last year’s Water Matters (2024) we saw significant downward shifts across nearly every area of customers’ views. In many cases, from trust to satisfaction with water and sewerage services, these were the lowest scores recorded in the thirteen years of Water Matters.

This year’s results show that the issue of falling trust and satisfaction with water companies highlighted last year is not a temporary one. Long-term trends remain negative, and in many areas, we saw scores decline further. However, it is important to note that a majority of companies saw improvement in their trust scores this year, but some saw steeper declines meaning the overall score fell.

Perhaps of most concern among this year’s Water Matters findings is that satisfaction with value for money, for both water and sewerage services, fell further, even below last year’s record low scores. Last year we commented on the widening gap between those who thought their water bill was affordable, and those who thought it was fair. This gap has also increased further this year. Satisfaction with value for money is unlikely to return to pre-2023 levels while customers increasingly feel their bills are unfair.

Our fieldwork was completed in December 2024, prior to the bill announcements in January 2025, so we are yet to see the true impact of the record bill rises in Water Matters. It is more important than ever for companies to continue raising awareness of affordability support and effectively communicate with their customers what they will be getting for their money.

We have seen an increase in this year’s Water Matters of customers contacting their company with billing concerns. With the announcement of significant bill increases since this fieldwork was carried out, the situation is likely to have grown even more pressing, with further bill impacts due from April 2025. More than a third (37%) of customers in England and Wales already think their household’s financial situation will change for the worse in the coming year.

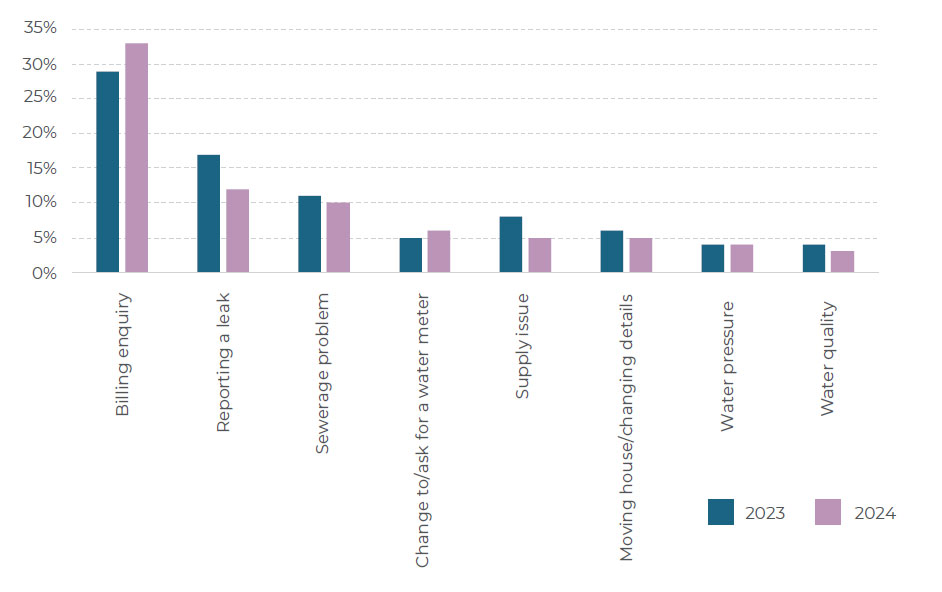

Once again, continuing a trend from last year’s report, customers are more likely to have contacted their company than ever before, with a record number saying they had contacted their company in the past twelve months – but satisfaction with contact has not seen a statistically significant increase from last year. We have seen a significant increase in the number of customers contacting their company with billing enquiries – now making up a third of all customer contact.

While it is encouraging that awareness of available financial support for those struggling to pay their bills continues to increase, it still remains the case that many customers receive little regular communication from their water company beyond bills.

We will now look at all these issues in more detail.

Small improvements are not enough to halt negative long-term trends

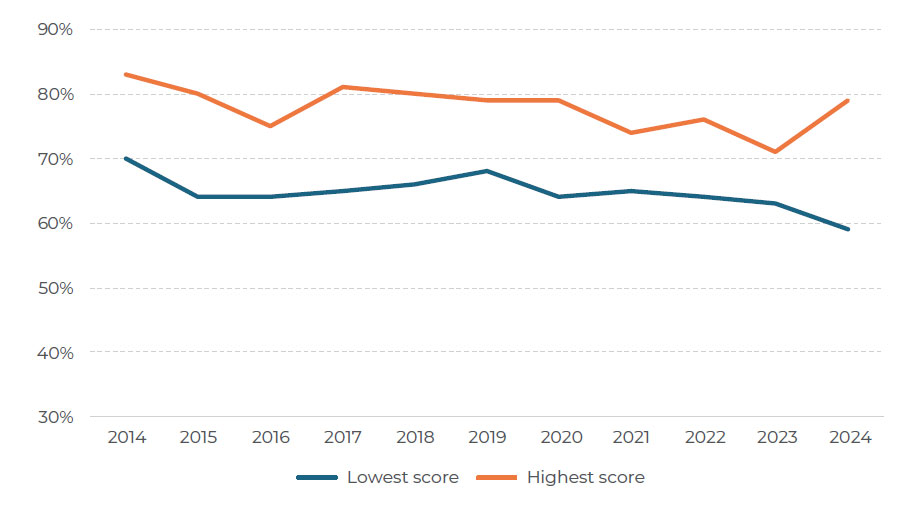

We are now seeing negative ten-year trends across a range of areas that had previously been static.

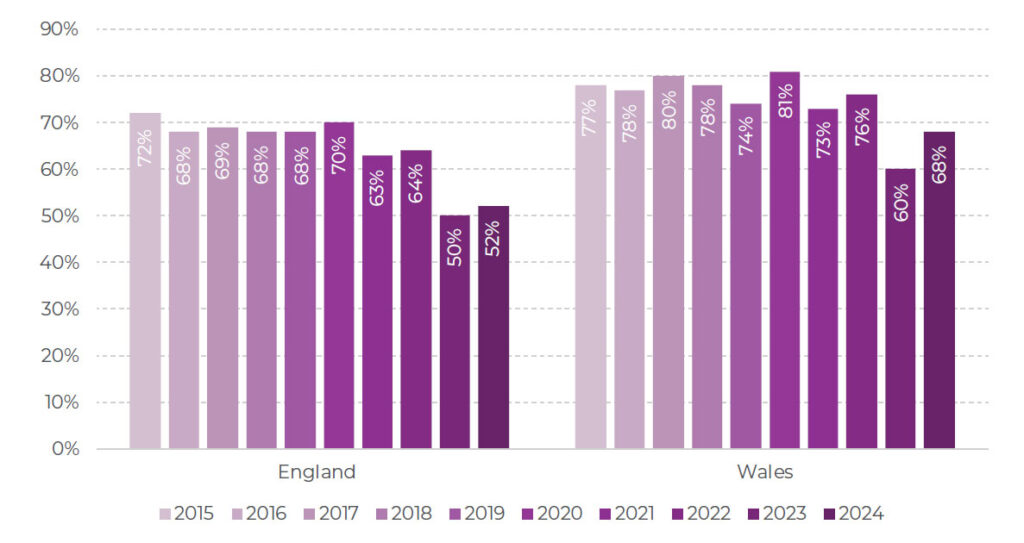

Indeed, in traditionally higher-performing Wales, in areas where the long-term trend was static (such as trust, satisfaction with value for money and whether the company cares about the service it provides), this year’s scores have turned the trend negative for the first time. (For an example of this, see Figure 1, below).

Even where there were small but significant improvements from last year, such as the proportion of customers agreeing that their company cared about the service it provides, these were still well below the score from two years ago.

Figure 1: Agreement that your water/water and sewerage company cares about the service it provides to customers, England vs Wales with long-term trend data

Similarly, while across each aspect of satisfaction with sewerage service, almost every company saw a small improvement (even in ‘satisfaction with cleaning waste water’ which saw the largest falls in score last year), these are still below where they were before the dip in 2023 – and the average score over the last ten years.

However, this year’s overall record low scores are in many cases a result of regional variation in customers’ views. For instance, a majority of companies improved their trust scores from last year. Among those that did not, scores fell further still – particularly Thames Water and South West Water – which resulted in the overall average trust score across England and Wales being slightly lower than in 2023 (6.28 in 2024 vs 6.37 in 2023).

But as table 1, below, shows, even where there were improvements – although welcome – trust scores this year are still far from the average over the past decade for every company.

Table 1: Changes in trust score by company, 2023-24, compared with the 10-year average

| Company | 2023 | 2024 | 10-year rolling average |

|---|---|---|---|

| Anglian Water | 6.45 | 6.46 | 7.45 |

| Dŵr Cymru Welsh Water | 6.94 | 6.86 | 7.79 |

| Hafren Dyfrdwy | 6.83 | 6.80 | 7.53 |

| Northumbrian Water | 6.90 | 6.91 | 7.75 |

| Severn Trent Water | 6.57 | 6.61 | 7.49 |

| South West Water | 6.14 | 5.42 | 6.96 |

| Southern Water | 5.44 | 5.74 | 6.77 |

| Thames Water | 5.79 | 5.12 | 6.81 |

| United Utilities | 6.62 | 6.57 | 7.49 |

| Wessex Water | 6.53 | 7.02 | 7.66 |

| Yorkshire Water | 6.63 | 6.50 | 7.61 |

| Affinity Water | 6.35 | 6.46 | 7.21 |

| Bristol Water | 6.54 | 6.70 | 7.59 |

| Cambridge Water | 6.37 | 6.77 | 7.49 |

| Essex & Suffolk Water | 6.93 | 6.81 | 7.45 |

| Portsmouth Water | 5.89 | 6.83 | 7.39 |

| South East Water | 5.49 | 5.81 | 6.93 |

| South Staffs Water | 6.52 | 6.70 | 7.50 |

| SES Water | 6.72 | 6.63 | 7.31 |

Companies in green improved their trust score from last year, while companies in red saw a further fall.

Value for money and concern with bills

When it comes to value for money, for both water and sewerage services (down to 65% and 67% net satisfied, respectively) as well as fairness of charges (down to 53% agreeing that charges are fair), this year saw scores fall significantly from last year’s record low scores. It is important to note that fieldwork took place prior to the announcement of bill increases in January 2025 – so the findings may not capture the full extent of the struggles people have with affording their water bills. But it is significant that, even before these increased bills are taken into account, over the last twelve months we have seen a significant increase in the number of customers contacting their company with billing enquiries – now making up a third of all customer contact (up from 29% last year). To put this in context, this is as much as the next four most common reasons for contacting put together (see figure 2)

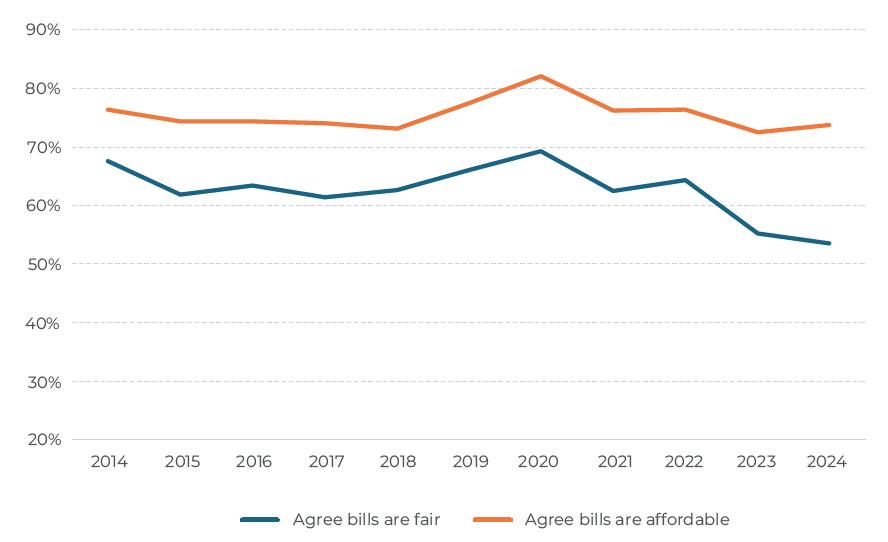

Last year’s Water Matters highlighted that the gap between affordability and fairness of bills had become wider than ever – a trend that continues this year (see figure 3, below), now with a 21% gap in agreement between the two, compared to 17% last year.

This issue of an increasingly perceived unfairness of bills is a significant one and is potentially driving wider customer perceptions. The companies whose customers agreed least that their bills were fair (South West Water and Thames Water) also scored lowest on whether customers agreed they cared about the service they provide. Similarly, among the top three companies for fairness of bills were the two with the highest score for care (Dŵr Cymru Welsh Water and Wessex Water).

Our recent research into customer priorities found that people want to see clearer, more transparent messaging on financial decisions and how they affect infrastructure improvements and affordability, in order to understand better how their money is being spent. This is an area for companies to focus on when it comes to addressing the issue of ‘fairness’ of bills.

This year’s survey showed that 37% of customers thought their financial situation would get worse over the next year – compared to 48% who said this last year. We also saw a slight increase in customers who agreed their bill was affordable – 74% in 2024 compared to 72% in 2023.

Whilst this seems to paint a more positive picture, this does not take into account the bills announcement in January 2025, and those who say their situation has improved would not necessarily be able to afford higher water bills. Our research carried out during the PR24 draft determinations showed that two out of five customers (40%) across England and Wales said the bill rises being proposed over the next five years would be difficult to afford. This reinforces the pressing need for water companies to improve the package of support offered to households struggling on a low income and still feeling the effects of the cost-of-living crisis, and to make sure this is well communicated.

Company contact

This year, a record number of people said they had contacted their company in the past 12 months – up to 27%, a significant increase from 25% last year. We also recorded the highest ever customer engagement score in Water Matters history.1

However, when it comes to overall satisfaction with contact, there has been little change from last year’s record low score – up slightly (but not significantly) from 74% to 75%. This represents a clear downward trend over the past ten years. As was the case in most previous years, satisfaction with ‘the way you were kept informed of progress’ was significantly the lowest of the different elements of contact. This is something that people have consistently said in our Water Matters surveys, and so is a clear area for improvement to help revive overall satisfaction scores.

Positively, there has been an improvement on last year’s score when it comes to ‘how well does your company communicate with you about its services and plans’. But the vast majority (81%) of those who said their company did not communicate well mentioned a lack of regular communication.2 This highlights an opportunity for companies as we can see a correlation between how well customers think their company communicates on its services/plans, and whether they think companies care about the service they provide. The need for improved communication is reinforced by the fact that we have seen an increasing public misconception in this year’s Water Matters when it comes to the safety of drinking water. People were significantly less likely than last year to be satisfied with this – down 3% to 85%, quite out of line with the wider trend of satisfaction with water supply. This chimes with our recent priorities research, which found that concern with the safety of drinking water was a growing topic of discussion online.

More encouragingly, the percentage of customers across England and Wales who were aware that their company offered financial support to those struggling to pay bills increased from 45% to 49% – almost reaching CCW’s Forward Work Programme target of 50% to be reached in Water Matters 2026.

While there was an overall increase in customers who said they would contact their company if they were worried about paying bills, this varies by company more than in any previous year, having narrowed in previous years – a 20% gap between the highest and lowest scoring company (see figure 5, above). As set out above, regional variation is an increasingly significant factor in our Water Matters findings. CCW wants to see a more consistent improvement across England and Wales in next year’s report. Companies will need to work together and share best practice to address this.

This year we will see a huge roll out of smart water meters across the industry, which will provide a great opportunity for companies to increase and improve their engagement with their customers. It is essential that companies get this right: ineffective communication around smart metering has the potential to further increase contact and impact negatively on satisfaction and trust.

1 The Customer Engagement score is put together by combining the following five individual measures: 1)Likelihood of contacting their water company if they are worried about paying their bill, 2) Awareness and/or subscription to additional help/services, 3) Awareness and/or subscription to Watersure/Watersure Wales/Welsh Water Assist and other special tariffs, 4) Awareness of their right to revert for free/meter for free, and 5) Whether they made contact with water/sewerage company

2 i.e. a response which was coded ‘don’t recall any communication apart from bill’, ‘not had communication’ or ‘don’t get regular correspondence’

Conclusion

This year’s Water Matters findings show that, although there has not been another significant decline in customer trust and satisfaction, meaningful improvement has been limited and most scores remain close to – or at – record lows.

CCW acknowledges that changing perceptions will take time and a significant amount of work. We can see that some companies have performed better than others, which highlights the opportunity for companies to work together and share best practice to collaboratively raise the perceptions across the industry.

Last year we said that water companies needed to focus on rebuilding trust in order to avoid further downward trends. While this year was not as dramatic, trust is still falling. However, most companies did improve their trust scores, but the poorer performance of a few companies brought down the overall trust score again this year. The public exposure and increasing knowledge of environmental issues has continued and although we saw improvements in some elements of sewerage services, the overall satisfaction in sewerage services fell by 1%.

Our message from last year on rebuilding trust remains the same – it must be a priority. Companies need to be transparent on performance, deliver on the promises made within their business plans, ensure they are communicating effectively with their customers and share best practice across the sector to improve the quality of services.

This year we have seen the introduction of the Water (Special Measures) Act which will place additional scrutiny on water companies to do the right thing and act on what their customers tell them, which in turn will help to earn back trust. CCW welcomes this inclusion in legislation to understand people’s views and make the necessary changes to help drive an industry with customers at its heart.

Over the last year, companies have continued to work with us to develop recommendations to improve the Guaranteed Standards Scheme – payments that they make to customers if they fail to meet statutory service standards, such as when people have no water or suffer from sewer flooding. This enabled us to make recommendations which were then taken forward by Defra. This will incentivise companies to have a customer-first culture, get things right first time and increase customer satisfaction and trust.

Although we saw improved scores in affordability, this is not the full picture given that the final bill announcements in January 2025 came after fieldwork had been completed. We are concerned about what these scores will look like in next year’s Water Matters.

This highlights the need for companies to ensure that they have effective support schemes in place such as social tariffs and working in partnership with external agencies in areas such as debt, to support the rising number of people who will find their water bill unaffordable. CCW is pressing for the introduction of a single social tariff which would provide a safety net, ensuring that water is affordable for everyone.

In 2024, companies worked with us to review the WaterSure scheme which resulted in the submission of our recommendations to Defra, which is looking to make improvements to the scheme.

Again this year, we have seen some large variances in people’s perceptions between individual water companies, and between England and Wales. This means that the progress being made by some companies can be overshadowed when we then look at the sector scores as a whole. This further highlights the need for companies to work collaboratively, sharing best practice and bringing innovation to the sector as a whole to deliver a quality service that people trust.

We will be following up this Water Matters report over the coming months with a series of mini reports, looking at different overarching themes from our research in more detail.